One of the most useful features of YNAB is the built-in Emergency Fund feature. It lets you plan a goal for your emergency savings and set a target year when you want to achieve it. Then, YNAB automatically calculates exactly how much you need to save every month to get there.

What Is an Emergency Fund?

Everyone should have an emergency fund set aside as a cushion for when life takes an unexpected turn for the worse. An emergency fund is a fairly large sum of cash that’ll cover either unexpected large expenses or enough to cover all of your bills for a few months or more. Events that might require an emergency fund include:

Losing your job.Having a medical emergency.Major home or appliance repairs.Major car repairs.Unexpected travel for family emergencies.

People have a problem with building up an emergency fund because there’s rarely room for it in any budget. However, as YNAB assigns all incoming funds to specific budget categories as the money comes in, it encourages you to allocate at least some income to this budget each month. Having this small nest egg can reduce your stress because even when something catastrophic hits, you’ll know you have some time to figure things out without it ruining your life.

How Much Should You Save in an Emergency Fund?

Most financial experts agree that you should have a safety fund like this to help you pay your critical bills for at least 3 to 6 months. To figure this out, look through all of your bills and add up those you couldn’t get away with not paying for 3 to 6 months. These would be things like:

MortgageCar loansGroceriesFuel to get to and from workUtilities like electricity, heat, and water

If you have enough room in your budget, you could also include expenses like credit cards, personal loans, and entertainment services. However, many of these can be extended or canceled for some time if you call the company and ask. Once you’ve calculated the total amount you need to survive for 3 to 6 months, it’s time to configure your Emergency Fund in YNAB.

Setting Up Your YNAB Emergency Fund

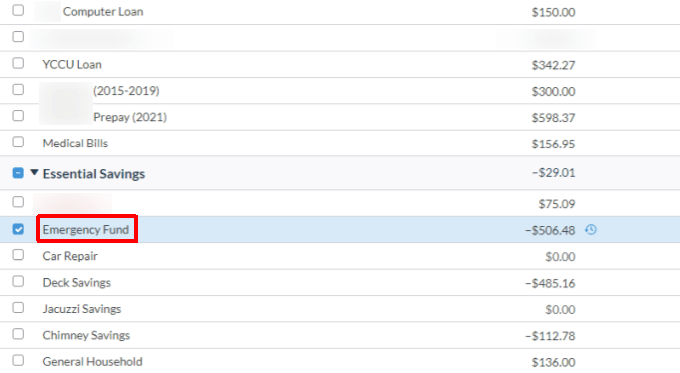

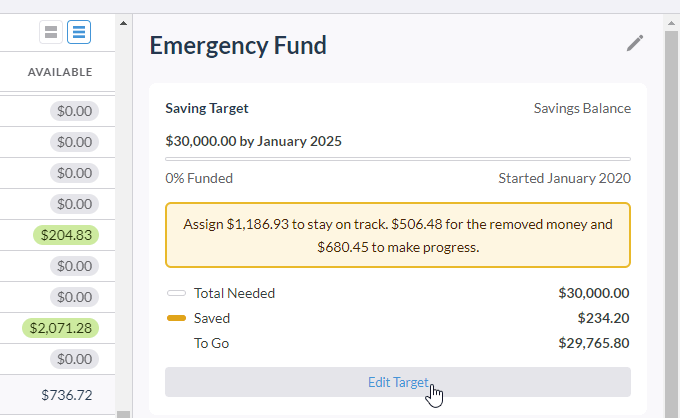

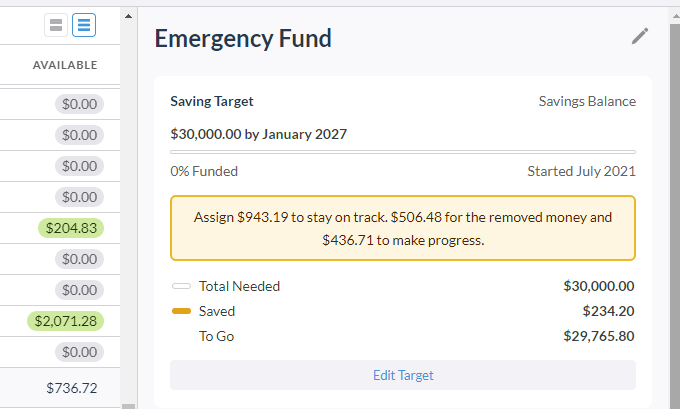

Open the YNAB website and log into your account. Scroll to the Emergency Fund item and select it. This will open the Emergency Fund editor in the right pane. Here you can configure and manage your emergency fund over time. At the top of this pane is the current status of your fund. You’ll see the target at the top and how well you’re doing funding it under the advice box. The advice box in the middle gives you some tips on how much you need to assign to the Emergency Fund this month to get closer to your goal. You’ll notice several options here.

How much to move back to the fund to make up for anything you spent from it this month (removed money).The amount you need to assign in total this month to stay on target with the overall savings trend from now until your target year.The amount you need to assign this month to at least make moderate progress toward your goal (even though it’s below the target savings trend).

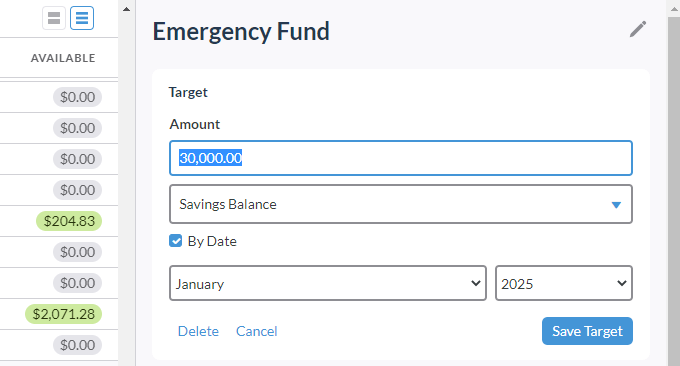

If you want to adjust your target savings goal (or if you haven’t set it up yet), select Edit Target. This will open the Target window where you can set the emergency fund goal and the date when you want to have that emergency fund fully available. Select Save Target when you’re done. Now that your emergency fund goal is set, you’re ready to start assigning funds to it every month and monitoring your progress toward that goal.

Managing and Monitoring Your YNAB Emergency Fund

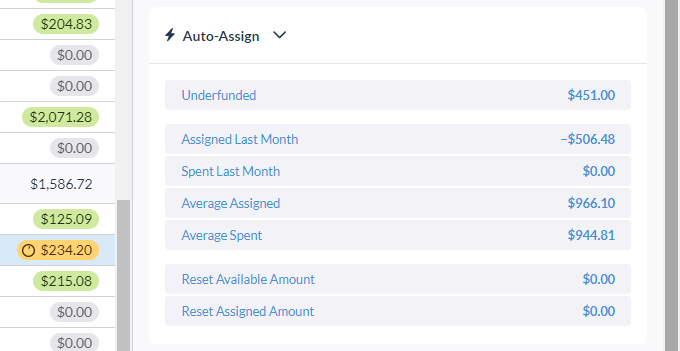

Each month when you select the emergency fund, the top pane will give you quick advice about what you need to do to reach that fund target by the date you specified. Ideally, you should hit the “stay on track” amount that the advisor offers in this box. That will ensure that you’re staying right on the savings trend estimated by YNAB. If you fall behind this in any month, you’re going to have to add even more the following month. This is a slippery slope to get into and will make it very difficult to hit your goal by the date you want to. YNAB also provides some quick links to help you assign the right amount of your monthly income. Just scroll down to the Auto-Assign section to see these. Select any of the following links to automatically assign the amount displayed to the right of it.

Underfunded: Budget just enough to fund the target, so you make some progress.Assigned Last Month: Use the same amount you assigned to your fund last month.Spent Last Month: Not relevant for an emergency fund.Average Assigned: Will budget the 12 month average of what you’ve been assigning in the past.Average Spent: Not relevant for an emergency fund.Reset Available Amount: Reset the available funds to 0.Reset Assigned Amount: Reset the assigned amount this month to 0.

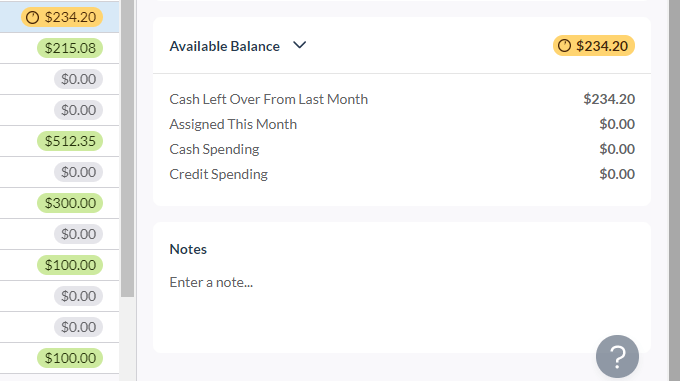

Toward the bottom of the right pane, you’ll see the totals related to your fund. This is where you can find the current total balance and how much you had leftover from last month that rolled into this month. You’ll also see the amount that you’ve assigned to the fund so far this month. Cash Spending and Credit Spending aren’t relevant for the Emergency Fund, so you can ignore these balances. One more thing to know about using the YNAB Emergency Fund is that you can quickly see a record of the past amounts you’ve moved in and out of the fund over time. Just select the small clock icon next to the amount you’ve assigned to the fund this month. A window will appear where you can scroll through the entire history of all of the transactions in and out of that fund.

Set Up Your YNAB Emergency Fund Now

The Emergency Fund in YNAB is the first thing you should assign money to. Don’t ignore this feature. Figure out how much you’ll need to live on for 3 to 6 months and set up the goal. Be diligent about assigning the amount you need to reach that goal. Once you do, you’ll be able to sleep better at night, knowing that even if life throws you a curveball, you’ll have the financial backing to absorb it.